Our goal at Benchmark Commercial Lending is to provide access to commercial loans and leasing products for small businesses.

The total amount of monthly deductions to the depreciation account is determined on the method best applicable for accounting for the regular wear and tear of a particular asset. Many middle-class homeowners opt to deduct their mortgage expenses, thus shielding some of their income from taxes. On the income statement, depreciation reduces a company’s earning before taxes (EBT) and the total taxes owed for book purposes.

The payment of the interest expense is going to ultimately lower the taxable income and the total amount of taxes that are actually due. Since adding or removing a tax shield can be significant, many companies consider this when exploring an optimal capital structure. An optimal capital structure is a good mix of both debt and equity funding that reduces a company’s cost of capital and increases reduce scrap and rework costs its market value. The tax shield refers to the amount of tax that has been saved by claiming depreciation as an expense. It’s calculated by multiplying the depreciation expense by the tax rate. Let us take the example of another company, PQR Ltd., which is planning to purchase equipment worth $30,000 payable in 3 equal yearly installments, and the interest is chargeable at 10%.

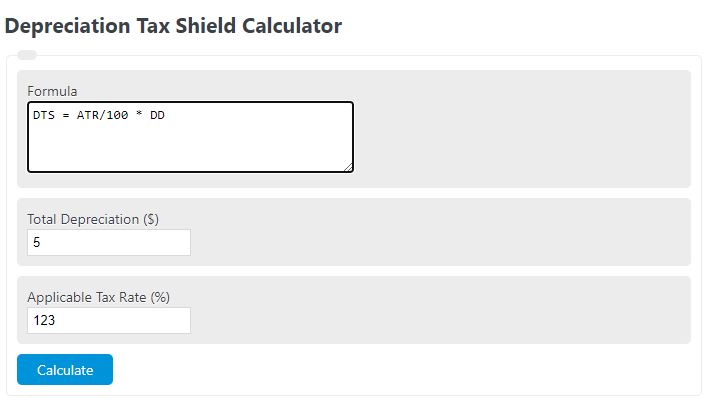

This will become a major source of cash inflow, which we saved by not giving tax on depreciation. The concept of annual depreciation tax shield is identified as an important factor during financial decision-making by the management in case the business is highly capital-intensive. The business operation will involve the use of assets of larger value resulting in a substantial amount of depreciation being deducted from the taxable income. Therefore, it is important to understand the formula used to calculate depreciation tax shield, as given below. For example, because interest payments on certain debts are a tax-deductible expense, taking on qualifying debts can act as tax shields.

Since depreciation expense is tax-deductible, companies generally prefer to maximize depreciation expenses as quickly as they can on their tax filings. Corporations can use a variety of different depreciation methods such as double declining balance and sum-of-years-digits to lower taxes in the early years. In addition, it does not matter if you buy something with your own money or you borrow this money. For this reason, a depreciation tax shield is considered a big advantage to real estate investing. Let’s look at the example of an owner of a fleet of trucks whose equipment depreciated over the tax year.

The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate, multiplied by the amount of depreciation. This tax shield can cause a substantial reduction in the amount of taxable income, so many organizations prefer to use accelerated depreciation to accelerate its effect. Accelerated deprecation charges the bulk of an asset’s cost to expense during the first half of its useful life. As the name suggests, tax shields protect taxpayers from paying taxes on their full income.

It also provides incentives to those interested in purchasing a home by providing a specific tax benefit to the borrower. Implementing an effective tax shield strategy can help increase the total value of a business since it lowers tax liability. Keep reading to learn all about a tax shield, how to calculate it depending on your effective tax rate, and a few examples. Here, we explain the concept along with its formula, how to calculate it, examples, and benefits.

Here we see that depreciation acts as a shield against tax, a cash outflow for the business. Tax shields allow taxpayers to reduce the amount of taxes owed by lowering their taxable income. When filing your taxes, ensure you are taking these deductions so that you can save money when tax season arrives. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield. An individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5% of adjusted gross income by filing Schedule A.

The Internal Revenue Service (IRS) allows businesses and individuals to deduct certain qualified expenses, thereby lowering their taxable income and their ultimate tax liability. This tax-efficient investment method is used particularly by high-net-worth individuals and corporations that face steep tax rates. Understanding the concept of a tax shield can have a significant impact on your financial decision-making. By taking advantage of legitimate deductions, tax credits, and depreciation allowances, businesses and individuals can minimize their tax liability and retain more of their hard-earned income. It’s important to consult with a tax professional or financial advisor to understand the specific tax provisions applicable to your situation and optimize the use of tax shields effectively. By doing so, you can make informed financial decisions and potentially better secure your financial future.